Contents

While appellees‘ premises are accurate, the conclusion of primary liability does not necessarily follow. The syllogism flounders upon the possibility that Section 11 liability attached to Cross for different representations than the Rule 10b-5 liability. Unlike liability under 10b-5, parties can be held liable under 11 even for negligent misrepresentations; accountants bear the burden of demonstrating due diligence once a plaintiff shows a material misstatement or omission in a registration statement. Rule 10b-5 violations require a showing of scienter because it, unlike Section 11, is an antifraud provision. Appellant contends this panel should overrule our decision in Xebec, ignore the Ninth Circuit’s decision in In re Alcala, and hold that a chapter 7 debtor’s attorney is entitled to an award of fees regardless of whether his services benefited the estate. Whether interpreting the Bankruptcy Act or the Code, the vast majority of courts require a chapter 7 debtor’s attorney to demonstrate that his services benefited the estate before granting an award of attorney’s fees.

However, I do not justify Ernst & Whinney as a result of the auditors besides from failure to note ‘pink flags’ had carried out few errors which lead to the legislation swimsuit. The first mistake that the auditors made concerned Mr. George Greenspan in the course of the 1986 audit. At 962 ( quoting In re Ryan, 82 B.R. 929, 931 (N.D.Ill. 1987)). Here, we must determine whether Cross himself committed a violation of Section 10 and Rule 10b-5, or whether the sum of his conduct only amounted to aiding and abetting others in their violations. Unfortunately, deciding when conduct constituting aiding and abetting rises to the level of prohibited primary conduct is not well settled. Appellant and appellees both rely on Central Bank of Denver to illuminate the distinctions.

The Trustee did not object to the debtors‘ claimed homeowners exemption in their residence, but contended there was some $588,000 of additional equity in the property that could be realized by the sale of the residence. MG G, on behalf of the debtors, filed an objection to the sale. The bankruptcy court approved the sale and the debtors appealed. This is a zzzz best inc 1986 very old case, and it is with a heavy heart that we act to prolong it. Our decision, however, is mandated by a supervening change in the law of securities fraud. We REVERSE the district court’s judgment and REMAND the case against appellant for a new trial to determine whether, in light of Central Bank of Denver, Cross violated Section 10 and Rule 10b-5.

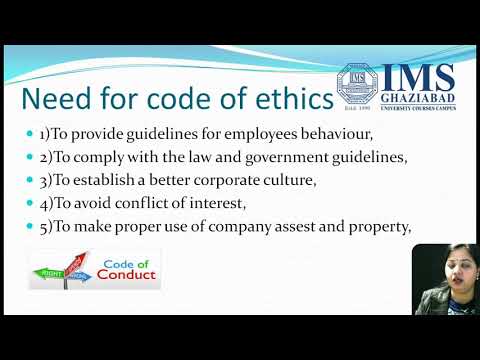

Great frauds in history: ZZZZ Best

This enchantment follows the trial court docket’s sustaining of the demurrer of respondent/defendant Ernst & Young (“E & Y”)1 to the second amended criticism (“SAC”) of appellant/plaintiff Union Bank (“Bank”). The SAC contained causes of action for fraud, conspiracy to defraud, negligent misrepresentation and professional negligence. Minkow had established Interstate Appraisal Services and Assured Property Management for the only real objective of producing faux insurance coverage restoration contracts for ZZZZ Best.

Rather, the cases, including Lumbert, involve the failure to raise an error in the instructions or the verdict before the jury was discharged, and a failure to ask for a specific interrogatory. Appellees suggest that we can tell from the verdict forms that the jury found Cross liable as a primary violator, particularly because it found him liable for violating Section 11 of the 1933 Act, 15 U.S.C. § 77k. Because liability under Section 11 requires finding that Cross allowed his name to be used in connection with a registration statement containing false or misleading information, see 15 U.S.C. § 77k, the jury found that Cross made an actionable misrepresentation. The jury also found Cross liable under Rule 10b-5, which includes the element of scienter.

Managed by IBS Times

First, however, we must determine whether Appellant’s request to remand for a new trial is an issue that was properly preserved for appeal. A California appellate court docket acknowledged Ernst & Whinney not liable to Union Bank of California which allegedly relied on Ernst’s evaluate report in extending $ 7 million to ZZZZ Best Co. The debtor’s opposition to the Trustee’s motion is not consistent with the debtor’s duties under section 521. Further, it is clear that the services provided by MG G obstructed the administration of the estate.

1239, 1251 (W.D.Mich. 1991) (holding that accountants “have a duty to take reasonable steps to correct misstatements they’ve discovered in earlier monetary statements on which they know the public is relying” ). Further, even if the bankruptcy court should not have allowed the Trustee additional time, the bankruptcy court would still have had an independent duty to examine MG G’s application sua sponte. At 209 ( citing In re Pettibone Corp., 74 B.R. 293, 299 (Bankr.N.D.Ill. 1987)). However, as indicated by the hearing transcript, the Trustee did not receive notice of the hearing. Under these circumstances, the bankruptcy court did not abuse its discretion by allowing the Trustee additional time to file its written memorandum.

The Supreme Court concluded the meaning of section 547 was plain on its face, and reversed the Court of Appeals. This is an appropriate case to exercise our discretion and consider whether remand for a new trial is necessary. Even characterizing the requested remand for a new trial as an „issue“ rather than an alternative form of relief, it is appropriate in these unique circumstances to consider the matter. It would not satisfy any policy behind the rule to turn our back on this significant question.

1439, 1448, , which holds that no aiding and abetting liability can be implied under Section 10. Based on this case, appellant moved for dismissal or, alternatively, for a new trial, arguing that Cross was not a primary violator of Section 10, and that his reckless https://1investing.in/ behavior could not subject him to Section 10 liability. The trial court denied the motion and the judgment was appealed to this court. Five days after filing the notice of appeal, the Supreme Court decided Plaut v. Spendthrift Farm, Inc., ___ U.S. ___, 115 S.Ct.

Once Hailed as Boy Wonder, Founder Barry Minkow Stands Accused of Fraud — The Lament of a Shareholder

Thus, Plaintiffs contend that E Y has dedicated a major violation of Section 10/Rule 10b-5 as a result of its participation in the additional misstatements or omissions apart from the Review Report. Defendant E Y now brings this motion for Summary Adjudication on two completely separate grounds. First, E Y contends that Plaintiffs can’t base their Section 10/Rule 10b-5 declare on any of the publicly released statements, apart from the Review Report, because of the U.S.

Appellant argues that none of Cross’s acts constituted fraudulent misrepresentations or omissions relied on by investing plaintiffs; at most the acts only aided Home-Stake in committing the alleged fraud. Appellees point to Cross’s certifications and opinion letters as evidence that he himself made misrepresentations or omissions sufficient to subject him to primary liability. The posture of this case bears striking parallels to Farrell. The bulk of the evidence and the argument on Cross’s liability involved his certification of balance sheets included in prospectuses made available to the Program investors, and his audits and opinion letters on Home-Stake’s consolidated financial statements. The thrust of the evidence went to his acts as a primary violator. Yet, some evidence and arguments in the record could be interpreted as going to aiding and abetting liability rather than to actual statements or omissions.

Its failure to do so raises a genuine problem of truth as as to whether it is subject to Section 10/Rule 10b-5 legal responsibility to the entire class because the Report might have continued to artificially inflate the market worth of Z Best securities. Debtors‘ counsel, Mayer, Glassman Gains („MG G“), submitted an application for allowance and payment of attorney’s fees and expenses. Appellant failed to object to a jury instruction and she likewise failed to object to the use of a general verdict.

- Of course the rule is not inflexible and „`the matter of what questions may be taken up and resolved for the first time on appeal is one left primarily to the discretion of the courts of appeals, to be exercised on the facts of individual cases.'“ Colorado Interstate Corp. v. CIT Group/Equip.

- As to reliance, Ernst & Whinney argue the information pled within the complaint show the financial institution did not rely on Ernst & Whinney’s evaluation report in extending credit score to ZZZZ Best.

- Through this forgery and theft, took his company ZZZZ Best to public in 1986 eventually reaching a market capitalisation of more than USD 200 million on the Stock market.

- On a case that was approaching the age of majority, another $36 million in prejudgment interest was awarded for these 10b-5 judgments.

- Appellant challenges the sufficiency of the evidence finding Cross liable for violating Section 10.

He certified Home-Stake’s Consolidated financial statements for those years. Cross’s opinions and certification letters were reproduced in prospectuses, annual reports, registration statements, and other Home-Stake promotional material. Appellees‘ expert testified that Cross must have known that his opinions themselves were false and misleading. The parties disagree about whether Cross’s acts were primary or aiding and abetting violations.

ANIXTER v. HOME-STAKE PRODUCTION

This rule is based upon the legislative history of Bankruptcy Code section 330 and the unfairness of allowing the debtor to deplete the estate by pursuing its interests to the detriment of creditors. Because the primary issue in this appeal involves Cross’s direct liability to appellees, we focus on the relevant facts concerning his involvement in the Home-Stake enterprise and allegations made regarding his direct participation in the alleged fraud. Against Cross, plaintiffs alleged primary violations of Section 10 of the Securities Exchange Act of 1934 and Rule 10b-5 of the SEC, aiding and abetting primary violations of Section 10 and Rule 10b-5, and liability under Section 11 of the Securities Act of 1933. Our analysis requires some extended recitation of facts. The grievance goes on to allege Ernst & Whinney knew its statements have been false but meant that Union Bank depend on the statements as if they were true and the bank justifiably relied on Ernst & Whinney’s false representations in extending a $7 million line of credit to ZZZZ Best.

Opinion: The what and why of stock market crimes

Appellant believes that the case demonstrates Cross’s acts and his peripheral position in the fraud are not behavior of the type that give rise to Section 10 liability; appellees read the case as reinforcing their view that accountants who make or certify material misstatements are still subject to liability. Plaintiffs, on the other hand, contend that the Supreme Court in Central Bank merely held that only when a secondary actor has not dedicated a manipulative or deceptive act itself but has solely assisted one other in doing so, is that secondary actor immune from Section 10/Rule 10b-5 liability. Plaintiffs assert that E Y was actively concerned in the writing and reviewing of the financial reviews and press releases offered to the general public by Z Best, and knowingly included data which was misleading and which was relied upon by the market.